The Distinctive Edge: Stock Analysis for Modern Shareholders

In today’s fast-paced financial landscape, participants are always seeking ways to gain an advantage in the market. The key to unlocking potential profits often lies in thorough equity analysis. Understanding how to analyze stocks, industry trends, and company fundamentals can be the difference between a winning investment strategy and one that falls short. With the rise of specialization in equity analysis, investors now have access to professionals who can navigate the complexities of the stock market, providing insights that are essential for making informed decisions.

Equity analysis specialists leverage their expertise to help investors discover opportunities and mitigate risks. They examine financial statements, review market conditions, and analyze a company's competitive position, all of which are vital components in finding the true value of an equity investment. By partnering with these professionals, investors can enhance their plans and ultimately position themselves for sustained success in an constantly changing marketplace.

Grasping Equity Analysis

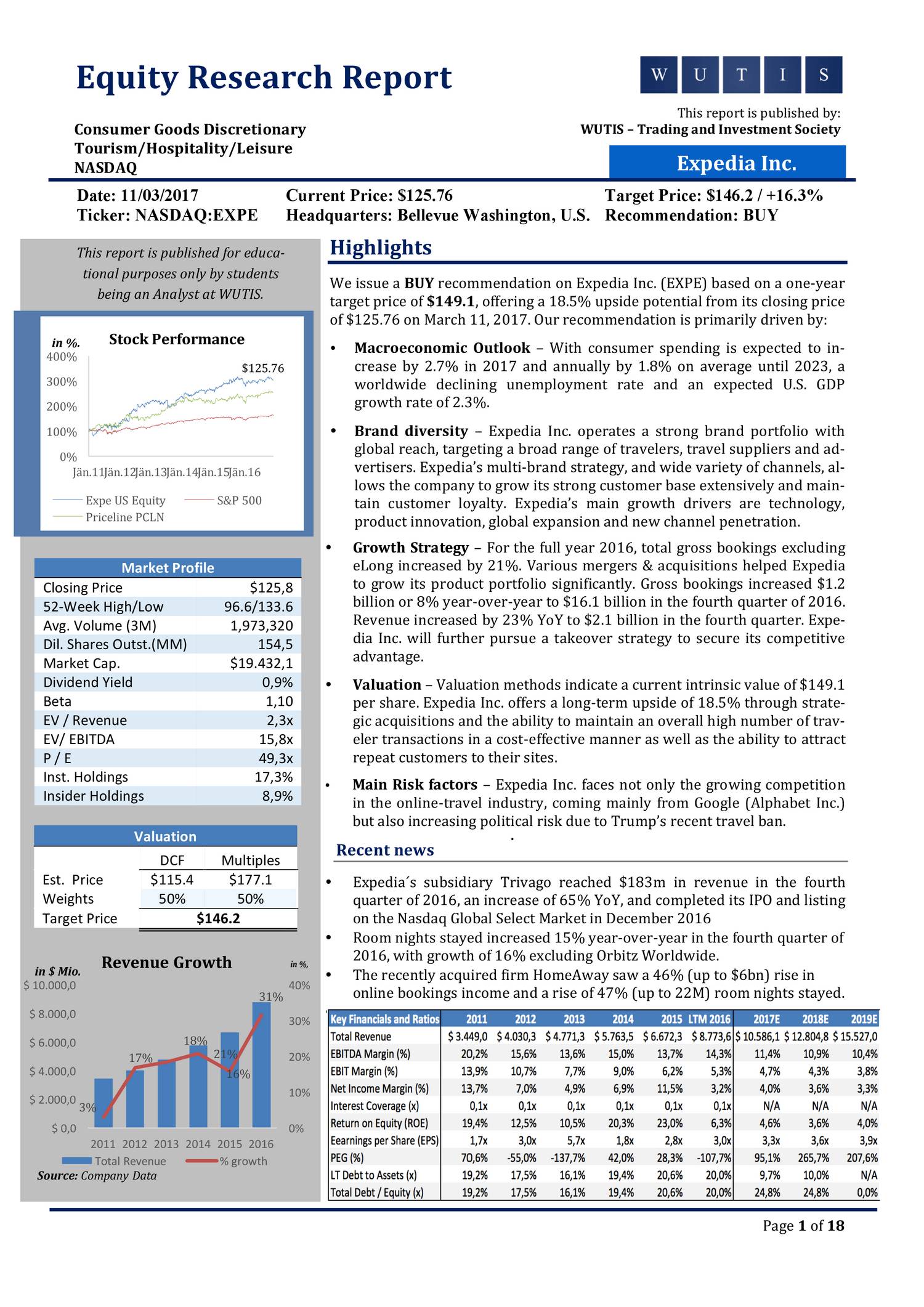

Stock analysis is a fundamental approach for investors wanting to make wise decisions about acquiring and divesting stocks. equity research report involves evaluating a company's monetary health, competitive position, and ability for upcoming growth. By assessing various metrics such as gains, sales, and market landscape, shareholders can gain understanding into the stock's price and determine if it is an fit buying opportunity.

One of the critical elements of equity analysis is the use of financial ratios and indicators. Analysts often count on ratios like price-to-earnings, price-to-book, and yield to evaluate companies within the same sector. These calculative measures not only help spot underpriced or overvalued stocks but also allow shareholders to benchmark their holdings against industry standards. Understanding these metrics gives shareholders a better view of a company's success relative to its competitors.

Moreover, stock analysis is not solely about numbers; it also includes qualitative factors. Analysts evaluate management effectiveness, market trends, and macroeconomic conditions that could impact a company's results. By integrating both numerical and qualitative assessments, traders can develop a comprehensive view of potential opportunities, ultimately boosting their decision-making strategy and improving the probability of achieving positive outcomes.

Key Metrics and Resources

As investors explore equity analysis, individuals should consider several key metrics that reveal a company's financial health and performance. One of the most important metrics is earnings per share (EPS), which shows a company's profitability on a per-share basis. Higher EPS values reflect better efficiency in earning profits, making it an essential figure for investors. Moreover, the price-to-earnings (P/E) ratio provides a comparison of a company’s current share price to its earnings, helping investors evaluate whether the stock is overvalued or marketed at too low a value relative to its earnings.

Another vital aspect of equity analysis is the use of tools that simplify data collection and analysis. Financial modeling software, such as Excel or dedicated tools, allows analysts to create comprehensive models that simulate various scenarios. Such tools help in predicting future earnings, estimating the worth of assets, and evaluating the impact of market trends on stock performance. Utilizing extensive financial databases enables investors to collect historical data and execute comparative analysis across industries, making the decision-making process simpler.

In conclusion, integrating qualitative analysis into the mix is crucial. Metrics focusing on company management, industry position, and competitive landscape offer context for quantitative data. Through the evaluation of leadership effectiveness and understanding market dynamics, investors can assess potential risks and opportunities that numbers alone often overlook. Combining these key metrics and tools creates a holistic approach to equity analysis, allowing investors to navigate today's competitive market landscape efficiently.

Approaches for Success

To enhance the gains of equity analysis, investors should first focus on understanding their investment objectives and risk tolerance. By clearly defining what they aim to achieve—be it long-term growth, income production, or capital safeguarding—investors can adapt their equity analysis to match with these goals. A thorough assessment of risk assessment helps in selecting stocks that suit the investor's comfort with volatility and potential declines.

Another key strategy involves leveraging the knowledge of equity analysis professionals. These specialists bring a abundance of insight to the process, helping investors make knowledgeable decisions based on in-depth market analysis and financial forecasting. Engaging with specialists not only conserves time but also provides a wide-ranging view of the market landscape, enabling investors to discover opportunities and steer clear of pitfalls that could arise from lack of data or misinterpretation of statistics.

Lastly, ongoing education and keeping updated with market trends are vital for accomplishment in equity investing. Investors should consistently review results reports, attend webinars, and participate in forums related to equity evaluation. This active approach ensures that they can adjust their strategies in response to market fluctuations and form a more nuanced understanding of the factors affecting stock performance. By integrating expertise with expert insights, investors can significantly enhance their choices capabilities in the equity arena.